What is a “Private Placement”? It’s an investment contract between “Accredited Investors” and a privately held company seeking to raise capital to expand and grow its business. Private Placements are the sale of securities (stock of a corporation, LLC membership interest, or debt that can be converted to equity in the business) by a company not registered on a stock exchange, including over-the-counter “Penny Stocks”.

Who qualifies as an Accredited Investor? The Securities and Exchange Commission has a definition here at this link: https://www.sec.gov/education/capitalraising/building-blocks/accredited-investor

A quick summary is that Accredited Investors earn enough money or have enough savings/net worth to afford an investment where they may not get their money back. That sounds a bit dire, but it was an outgrowth of the Roaring 1920s when people sold speculative stocks door-to-door on margin to ordinary folks who wanted to get in on the big stock market boom. As Syracuse Private Placement Attorneys, we can provide guidance on investment options and help you navigate the complexities of accredited investor requirements.

Institutional investors could buy stocks for only 10% down, and pay the rest later, presumably out of your profits when you sell your shares later. As the markets collapsed at the end of 1929, not only were many big businesses and banks wiped out, but so were many individuals who lost their life savings to these peddlers of “Blue Sky” investments.

Laws were passed that limited the direct sale of unregistered securities only to those people who were not depending on those funds; who had money to invest without putting themselves at the risk of being destitute if the investment didn’t pay off. Those small businesses can still seek investment contracts before being listed on a stock exchange (“going public”), but only if they follow certain guidelines and regulations to protect the public from fraud.

Under federal securities laws, any offer or sale of a security must either be registered with the SEC or meet an exemption. Regulation D under the Securities Act provides several exemptions from the registration requirements, allowing some companies to offer and sell their securities without having to register the offering with the SEC. Specifically, Rules 504 and 506 are critical to ensure SEC compliance. As Syracuse Private Placement Attorneys, we can assist you in understanding and complying with these regulations.

Rule 504 puts a cap on how much capital a company may raise via unregistered securities under Regulation D in any 12-month period (subject to numerous conditions), and Rule 506 is “safe harbor” provisions that allow companies to raise capital investment from “Accredited Investors”.

Further information at the link: https://www.investor.gov/introduction-investing/investing-basics/glossary/regulation-d-offerings

Today, private placements have been popularized by the television show “Shark Tank”, where owners of small companies pitch their business concept to a group of experienced Accredited Investors. Shark Tank adds some drama to raise equity capital, to make for good television. But the show has popularized the notion of entrepreneurship – and venture capital investment – in the United States since the series premiere in 2009.

When your company seeks private investors, you must choose an experienced attorney to help you draft your Private Placement Memorandum and accompanying Subscription Agreement. These are the contract documents that set the terms for the investment, how much equity is for sale and at what price, how much equity the investor is buying, risks associated with the investment, and the intended use of funds by the company.

You may be familiar with a document called a “Prospectus”. If you invest in mutual funds from companies like Fidelity, Vanguard, or Morning Star, you are sent a pamphlet in the mail, or download a PDF file that tells you the investment strategy of that particular fund (e.g., “We invest in growth companies in foreign markets”), the risks of the investment and the fees charged by the investment company.

A Private Placement Memorandum is your company’s “Prospectus” on the investment opportunity, but with one big caveat: you can be sued by the investors, if the company doesn’t do what it says it will do with the money. As Syracuse Private Placement Attorneys, we can help you draft a legally sound Private Placement Memorandum to protect your interests.

There are procedures to be followed in soliciting investment. Private Placement Memos are supposed to be individually numbered, and there is a window of time for the investment to be completed. The investor executes a Subscription Agreement to place their order/request for the specified number of shares. Sometimes, however, more people want to invest than the company has available equity that it’s looking to sell, which is called “over-subscription”.

This can lead to dissatisfaction among potential investors. To avoid any problems, and to present a feeling of integrity about the investment opportunity, it is essential for privately held businesses to choose an attorney experienced with financial statements, equity securities, bank loans, and financial instruments to help them with the entire investment process.

Investor appetite for private placements may grow after a down year among VCs in 2022. Investors see substantial market volatility and looking for new alternatives for investing their money. For those with an appetite for high-risk / high-reward opportunities, be sure to do your due diligence on the company making the Offering.

Over the last several years, recent developments in the Venture Capital space have seen most Tech industry start-ups moving to SAFEs – “Simple Agreement for Future Equity”. The incubator program Y Combinator developed these new investment forms about 10 years ago and has become very popular in these circles. Their popularity is because SAFE is an investment contract from the Founder, which essentially says “We aren’t sure how much money we may be worth right now. But we do need investment, and we’ll tell you how many shares you bought when we get our NEXT round of investment from big venture capital firms.” The rationale is that a VC firm or institutional investor will better understand what the company may be worth than its Founders.

Investment Amount: The amount of money the investor gives the company for the SAFE contract. The terms and conditions of the SAFE should specify the triggering event that converts SAFEs to common shares, and how and when those shares may be traded.

Conversion Event: The investor amount is converted into shares, only if there is a conversion event. Two main types of conversion events are:

Qualifying round: A subsequent “priced equity round” for raising investment. Shares are issued to the investors who put money in the qualifying round and to those who invested earlier through a SAFE.

Exit event: You, as the founder or CEO of your startup exit the ownership of your business. In an exit event, investors can choose to convert their SAFE into shares, or they can sell their ownership, too.

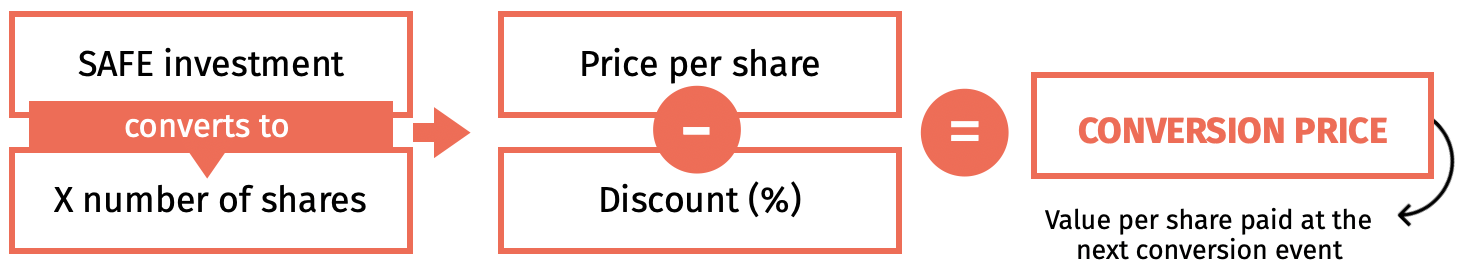

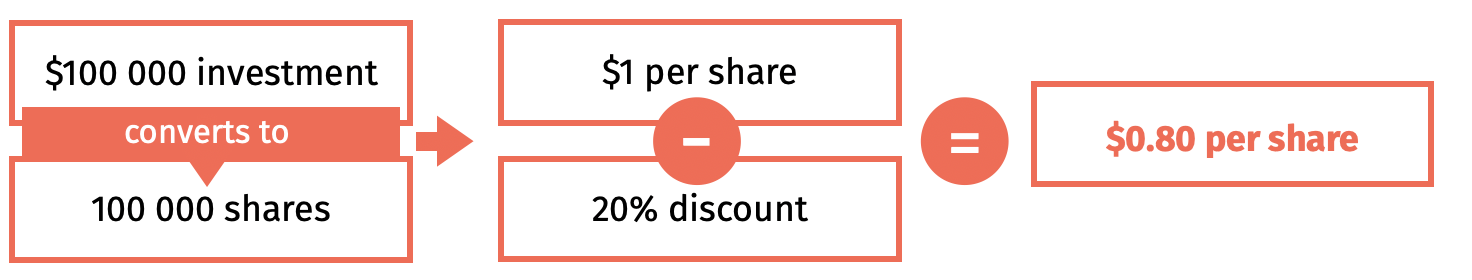

Conversion Price – The conversion price is best described as a pre-agreed discount on the share price at the time of a conversion event. This rewards investors for the high risk of investing in the startup pre-valuation. However, this “reward” may be illusory. Target share prices may, or may not, be met by subsequent investors. Even if they are, there is a high risk of dilution, as many SAFE holders do not have a full and accurate picture of the Company’s fully diluted capitalization table.

With the 100,000 shares valued at the conversion price, the investor receives $125 000 of equity for a $ 100,000 investment. A premium of 25%.

Valuation Cap This is the upper limit on a company’s valuation at which the SAFE investment amount is converted to shares. So, if a SAFE includes a valuation cap of $3M and the company holds a qualifying round at a valuation of $5M, the investors will receive their shares at the $3M share price. This protects investors from receiving a smaller number of shares than initially agreed.

This is a great vehicle for Founders, because they don’t have to worry about “down rounds”, and don’t have to really commit to a valuation. Valuation can be tricky for Founders if they price their business too far off the mark. As a Syracuse Private Placement Attorney, I can provide guidance on structuring investments and navigating valuation challenges.

However, SAFEs don’t have a maturity date, like a more traditional convertible note would. So, the investor gets no interest payments, and there is no deadline for converting the debt into shares. These are the 2 principal benefits to investors who hold convertible notes. An investor will never reach a conversion event if the company does not raise a later-priced round in the target range. So, this leads to zombie companies whose past investors hold no equity and have no incentive to make further investments.

With more traditional investments, if investors believe in the Founders and the company’s progress, they choose to make further investments. But if they get no equity and no guaranteed return, where is the incentive? There isn’t any. SAFEs treat early-stage investors like their money doesn’t matter; it’s just a bridge loan to a better future.

SAFE holders are not shareholders, so they won’t have shareholders’ rights until shares are issued at a conversion event.

SAFE holders can’t predict share dilution. If a company has issued a heap of SAFEs before a conversion event, they may dilute significantly when they convert to shares. SAFE holders don’t get the traditional disclosures required under Reg. D Private Placements by the SEC. SAFE holders receive different levels of disclosure based on the amount of their respective investments. This undermines the premise that free markets are built upon – fair and equal access to information.

From the traditional early investor’s perspective, this new development is a terrible deal. Early investors used to be rewarded for taking risks to invest in a start-up company when they most needed the money. It used to be that the Founders telling investors what they thought their company was worth, and how much investment they needed, was the essence of early-stage pitches to test whether a business is viable.

With the proliferation of SAFEs, the Founders don’t have to commit to a valuation – how many shares you bought for your $25 or 50K investment – until more money comes along later. If an investment contract exists, the later money will inevitably collaborate with the Founders to maximize their positions by minimizing the value of the earlier money. This is the opposite of how investing has worked historically.

Early money traditionally has taken the biggest risk and gets the biggest reward. I’m looking forward to the pendulum swinging back in favor of early investors, who are the true heroes of the venture ecosystem.

Meanwhile, I, a Syracuse Private Placement Attorney, focus on helping real businesses (not paper start-ups) secure investments using more traditional instruments. To raise money for a real profitable business with customers and operating history, not a speculative start-up, contact me for assistance.

For a free consultation, feel free to contact us at mattvanrynesq@gmail.com.

At MattVanRynLaw.com, we offer specialized legal services tailored to meet the unique needs of businesses in Syracuse, NY. With a focus on providing strategic counsel and effective representation, our team specializes in the following areas:

Startup Business: Our startup business lawyers provide comprehensive legal support for new businesses, including business formation, contract drafting, and compliance advice. We understand the challenges of starting a new venture and are here to guide you every step of the way.

M&A Attorney: For businesses involved in mergers and acquisitions, our M&A attorneys offer expert guidance to navigate the complexities of these transactions. From due diligence to contract negotiation, we ensure that your interests are protected throughout the process.

If you’re in need of experienced legal representation for your business in Syracuse, NY, contact MattVanRynLaw.com today. Our team is dedicated to providing you with the highest level of legal service and support for all your business law needs.